The format of this publication is a network interview. We present two companies that might be interested in each other as customers or business partners.

Orient Finans Bank is one of the leading banks in Uzbekistan. At the beginning of 2022, the bank’s assets amounted to 5 trillion 832 billion soums (about $523 million).

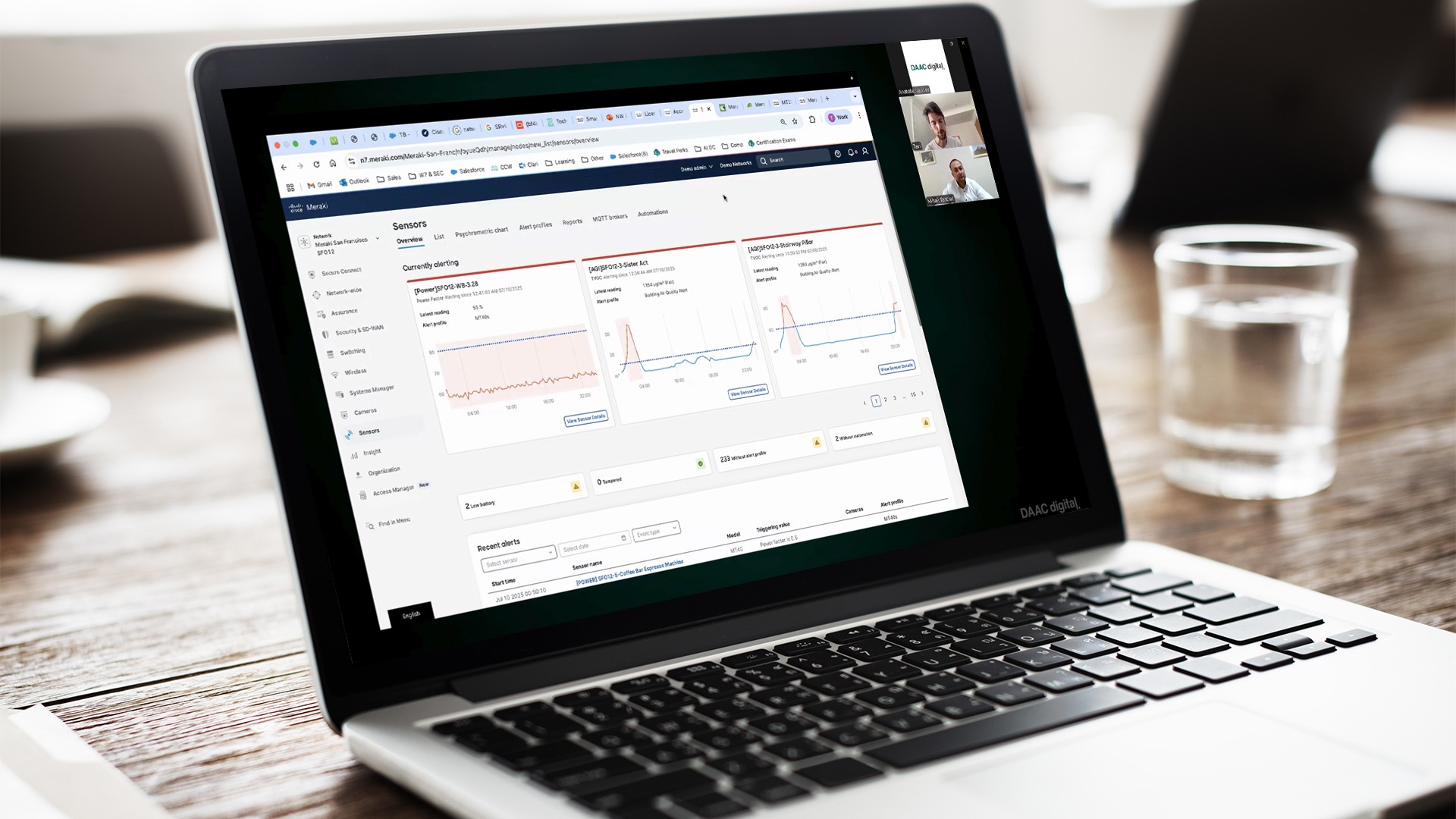

DAAC digital is an international group of IT companies founded 25 years ago and present on the markets of Moldova (headquarters), Romania and Uzbekistan.

At the top of the interview is a recording of a conversation with Bahram Yuldashev, Director of Strategic Development at Orient Finans Bank.

Orient Finans Bank is a private bank established in 2010. There is no state participation in the bank’s capital, as the bank’s capital is 100% owned by Uzbek individuals and companies. Currently OFB, with assets of over $500 million, is already in the top ten of the entire banking system in Uzbekistan. Our own processing center works with all leading global payment systems, including Visa and Mastercard, and serves not only our bank, but also eight other joint-stock commercial banks in Uzbekista.

Of course, we also work closely with local UZCARD and HUMO card payment systems, being for the latter a processor and settlement bank for international card purchases.

How is your branch system represented in Uzbekistan?

OFB has seven branches, bank offices and banking service centres are sufficient in most parts of the country.

You mentioned your own processing centre. It is interesting to compare how Moldova and Uzbekistan have developed in this direction since independence. Today, we have three processing centres owned by private banks, which serve the rest of the banking system in Moldova. And in Uzbekistan?

There are at least seven processing centres in Uzbekistan. But OFB’s processing centre is unique in its capabilities. We work with a maximum number of international payment systems. These are Visa and Mastercard, which I have already mentioned, ChinaUnionPay, China’s national payment system, and JCB, Japan’s largest payment system and one of the top seven payment systems in the world.

If we talk about payment systems in Uzbekistan in general, our country has a peculiarity that is not present in all CIS markets – there are two large-scale nationwide payment systems – Uzcard and Humo. Both systems have issued more than 32 million cards. Uzcard will be 20 years old in two years, this payment system was initiated by the Association of Banks of Uzbekistan. Humo is a “younger” system, operating under the Central Bank.

It seems that banks in Uzbekistan issue not only international card products, but also local products?

Yes, it is. Because of this, P2P payments are highly developed in Uzbekistan. As for the international payments market, many banks have set up their own processing centres. One of the first such processing centres was our OFB processing centre. Its unique feature is that we are a settlement centre for international Humo cards, and in this direction we cooperate with the Central Bank, so, given the volume of transactions processed, we are in a way a systemically important bank.

With such a high level of development of P2P payments in Uzbekistan, there should be quite low fees for transfers between individuals?

As for intra-bank transfers, none of the banks include a fee, although a small fee is certainly charged by banks for such transfers. When transfers are made between customers of different banks, the level of commission can vary from 0.1 to 1%.

Again, familiarizing ourselves with the peculiarities of payment settlements in Uzbekistan, it should be noted that the country has a historically developed fintech sector. In payment systems, the largest of which are CLICK and Payme, a user of any bank can register their card and make P2P payments within the system. And these are not just payments between individuals, but also e-commerce. Billions of dollars a year pass through payment systems.

So banks face tough competition in the private banking sector?

It’s not easy to compete with fintechs in terms of convenience, convenience and number of connected partners. But there are prospects for such competition, as banking apps are more functionally rich and there are opportunities for online lending and deposit-taking. So we are looking forward to an exciting period of development.

Thanks for the trip into the peculiarities of the banking system in Uzbekistan. But let’s talk about Orient Finans Banking. Given that the bank was established twelve years ago, I wonder what model was used to set it up. Was it a traditional model with a focus on own branches or was there an immediate plan to focus on digital technologies?

Before 2016, the banking system in Uzbekistan could be classified as very conservative and traditional. We were working under old banking rules, there was no dynamism, and many banking rules were already outdated. Yes, there were, of course, client-banking systems for businesses, but there were no banking applications for individuals.

In 2013 -2014, CLICK and Payme appeared, but the real changes in the banking system began to appear only in 2018, when the Decree of the President of the Republic of Uzbekistan “On additional measures to improve the accessibility of banking services” of 23.03.2018 № PP-3620 was issued. The resolution forced banks to create their mobile apps and develop retail products, because before that our banking system had a very strong bias towards serving corporate customers. Mortgages were only in their infancy and cars, although Uzbekistan had developed its own car production, were sold for cash only and bank loans for this purpose were not issued.

These historical particularities have certainly been reflected in OFB’s activities, but the market has changed dramatically in recent years. Since 2016, the new president has initiated huge positive changes in the country. Large-scale construction has begun, Uzbekistan has begun to open up to the world, year by year we are becoming a centre of attraction not only for our traditional partners Russia, China and Kazakhstan, but also for South Korea and Turkey. It should be taken into account that of Uzbekistan’s 36 million inhabitants, the predominant share of the population is under 30. Our demographics are very promising for economic growth.

And now OFB is actively transforming itself into a digital bank?”.

While in 2010 the bank mainly served corporate clients, in 2018 it started to work actively with individuals, focusing on the retail segment. At that time, P2P was a “must have”, payment for services was a “must have”, but credits and deposits remained.

Since 2018, we have launched online lending for individuals without collateral and have been actively involved in mortgage lending and car loans. While before 2016, the share of loans to individuals did not exceed 0.5% of the loan portfolio, this share is now over 30% and growing.

Currently, the Central Bank is recommending a shift from branch structure to smart offices and banking service centres and our development strategy is built in this direction. Now the customer is no longer tied to “his” branch and can benefit from equal services in any branch of the bank.

The bank’s organisational structure is also changing. The management of the bank’s activities by numerous departments is simplified, favouring universal departments that can handle a wide range of customer problems and tasks.

And the digitisation of services?

This is the most important task now. Digitising mortgage loans, digitising car loans, it is important that the customer does not have to come to the bank to deal with these tasks. Every minute saved for customers is a minute of gratitude for the bank, and we appreciate that gratitude. We also have a lot of work to do on integrating money transfers into mobile apps. So there is a huge amount of work to be done in the coming years.

To conclude our conversation, what promising ways of cooperation between the Moldovan and Uzbek business environment do you see?

I think it would take a lot of space to list all the directions. But I would name among the first directions the growing wine sector in Uzbekistan; Moldovan winemakers may be interested in sharing their experience or establishing partnership relations with our country. Without a doubt, everything related to construction and home improvement is promising, as this sector is experiencing explosive growth in Uzbekistan. I am sure that our market can be interesting for the Moldovan IT sector as well. I can assure you that Orient Finans Bank is open to any productive cooperation.

Pavel Zingan

Source:pavelzingan.md