For Personnel Officers

Set up payroll systems, payroll and accounting

“1C: Salary and Personnel Management” allows you to automatically calculate wages, income tax and insurance contributions in accordance with the legislation of RM, including organizations with a large number of employees.

In “1C: Salary and Personnel Management” all forms of labor remuneration are implemented: time-based (using monthly, daily and hourly wage rates), piecework or using a bonus system. In accordance with the acts of the organization, various bonus options can be specified in the program. You can set up any accrual and deduction: fixed amount or arbitrary formula. As a result, the information system sets all the characteristics necessary for the automatic calculation of wages, income tax and contributions for each accrual and withholding. This allows all calculations to be made in accordance with the accounting policy of the organization.

The sizes of all tariff rates are set in lei with the accuracy specified in the initial program setup. Rates may be determined by wage scales according to the grades of employees. More than one rate of pay may be applied simultaneously for one employee. During the initial setup, you can specify options for the organization’s bonus system.

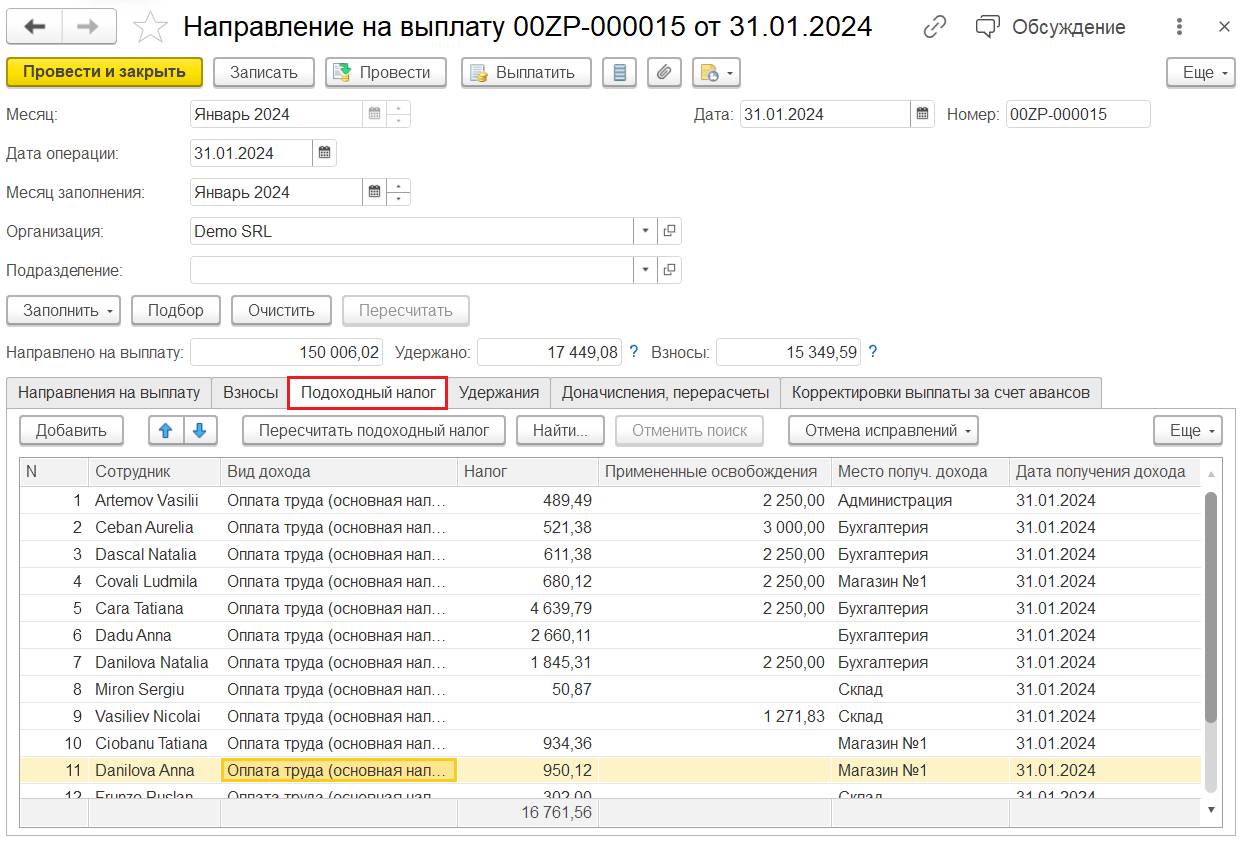

Assessment of taxes and contributions

“1C: Salary and Personnel Management” provides calculation of statutory deductions from the employee’s income:

- personal income tax (income tax);

- social security contributions;

- contributions for compulsory medical insurance.

Income tax withholding is calculated automatically for each employee, taking into account their exemptions.

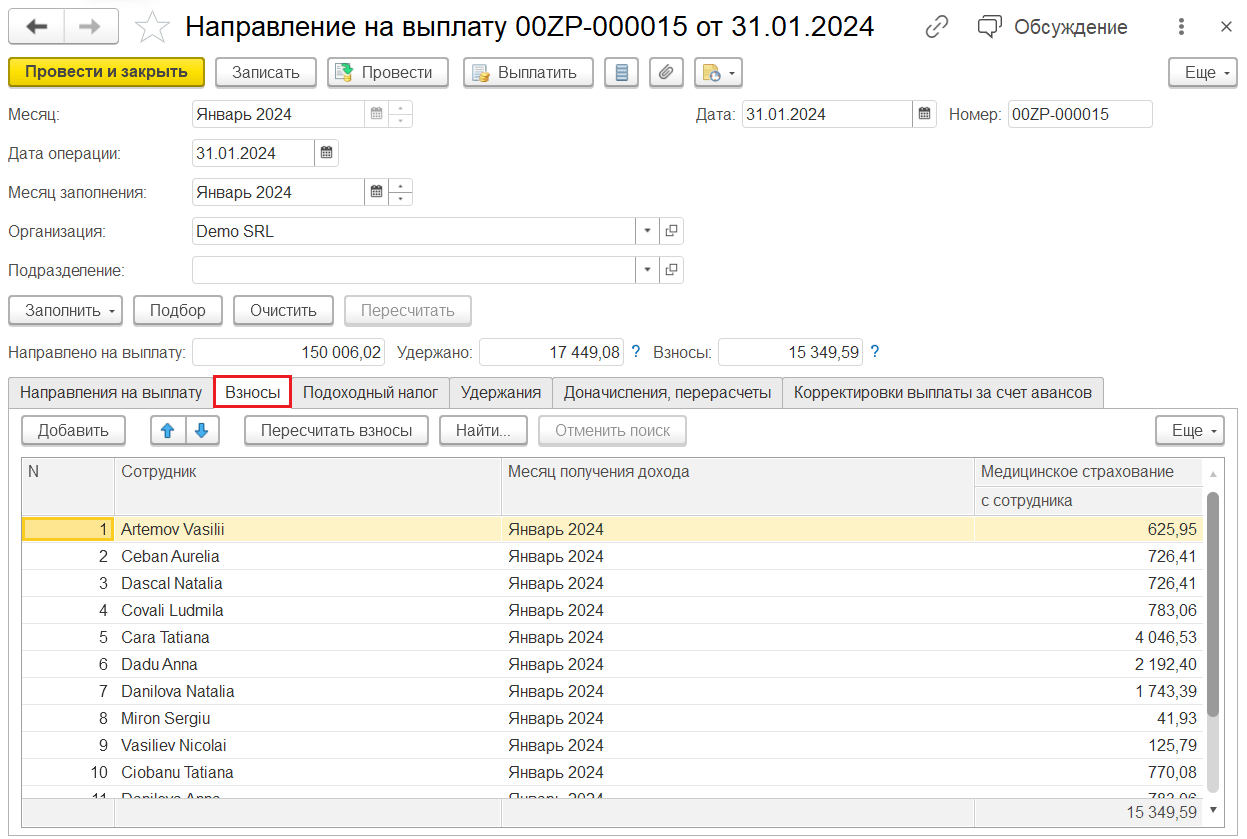

Insurance contributions are calculated automatically when payroll income is accrued according to all kinds of tariffs stipulated by the legislation taking into account the insurance status of employees – resident or non-resident.

Contributions for compulsory health insurance are calculated automatically when income is sent for payment.

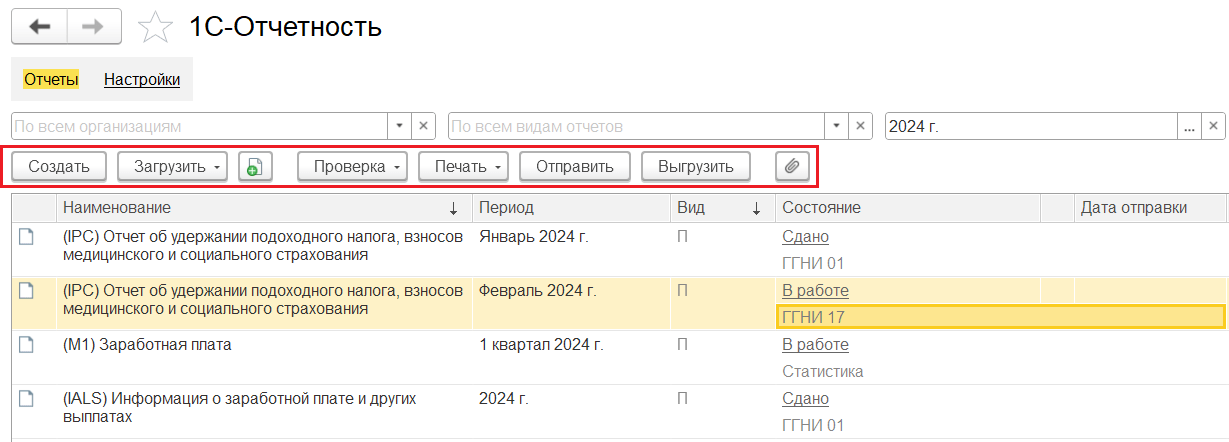

Reporting to regulatory authorities

Based on the results of accounting of employees’ income, amounts of calculated taxes and contributions, data on payment to funds, regulated tax and statistical reporting is automatically generated:

- Report on withholding of income tax, health and social insurance contributions (IPC);

- Information on wages and other benefits (IALS);

- Employee Movement and Jobs (LM-Annual);

- Employee Movement and Jobs (LM-Quarterly);

- Wages and salaries (M1);

- Distribution of the number of employees by size of accrued wages (M2);

- Pay and Cost of Labor (M3);

- Occupational Accidents (AM);

- Vocational training of employees (FORPRO);

- Information on the establishment of labor-related social and health rights (IRM).

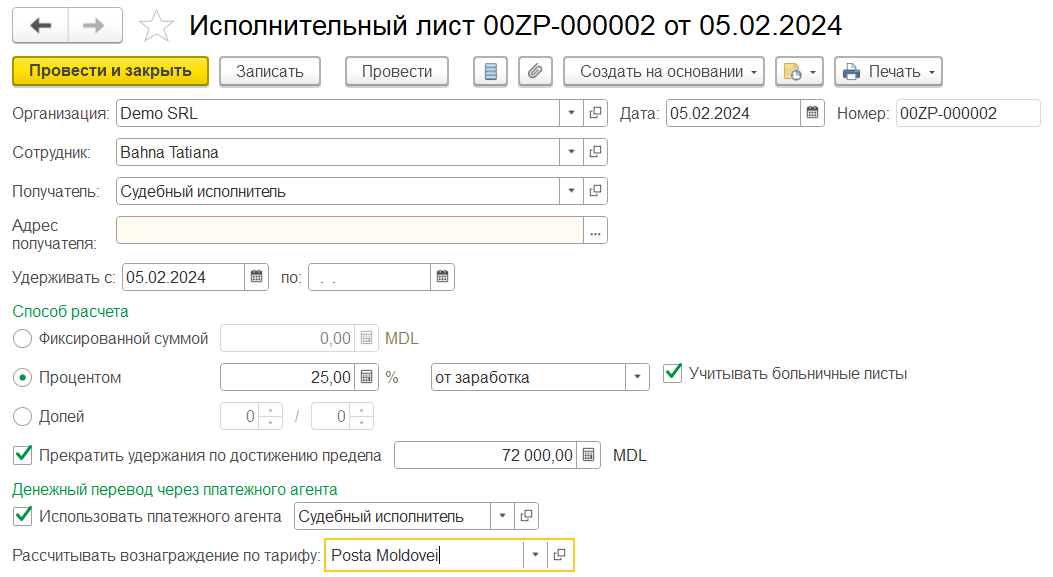

Withholdings from wages

“1C: Salary and Personnel Management” allows you to calculate withholdings:

- by destination – union dues, writ of execution, remuneration of the paying agent, withholdings for unearned vacation days, withholdings on account of settlements on other operations, other withholdings in favor of third parties;

- monthly or only when an indicator value is entered;

- by other means – a fixed amount, up to a specified limit, or a formula based on a combination of any data available in the regulated calculation methods.

In “1C: Salary and Personnel Management” is realized the control of limitation of penalties in accordance with the requirements of Art. 149 of the Labor Code of RM.

Mutual settlements with employees

“1C: Salary and Personnel Management” automates and documents the entire labor-intensive process of salary payment. Salaries can be paid to employees:

- in advance – as a result of advance payment for the first half of the month, a fixed amount, a percentage of the tariff;

- in the inter-settlement period – vacation pay, financial aid, travel expenses, dismissal pay;

- based on the month’s performance.

Payments under GPH contracts may be made in a lump sum or on the basis of acceptance certificates for work stages.

The program allows you to prepare statements for payment or transfer of funds and automatically fill in:

- staff lists

- amounts payable

The program generates appropriate printed forms or files for unloading statements to the bank and loading them into “Client-Bank” (for each bank a different format (structure) of transmitted unloading files is automatically generated).

Amounts may be paid to an employee by crediting a card opened as part of a payroll project, by transfer to a bank account, through a cashier or a dispenser (a person authorized to transfer money). For the convenience of preparing statements in the program, you can set up the method, place of issue and authorized person for the whole organization, for a subdivision of the organization or for an employee.

The program generates hardcopy and electronic documents required to make payments to employees in various ways. A statement is provided for each method (location) of payment.

Bank accounts can be opened centrally for employees as part of a so-called payroll project. Moreover, an organization may open several payroll projects at the same time. The employee can also specify a personal bank account for salary transfer.

Registers indicating amounts and applications for opening personal accounts shall be transmitted to the bank, as a rule, in electronic form. In this case, the file can be sent to the bank via special communication channels, for example, through “Client-Bank”, or transferred on a physical medium (flash card, disk).

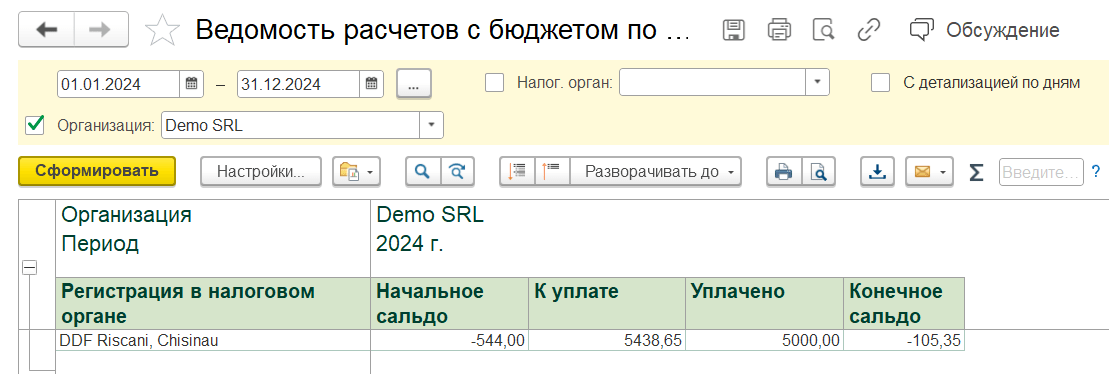

Mutual settlements with the budget

Accrual of income tax payable to the budget is performed automatically when wages are sent for payment in the context of tax divisions.

Transfer of income tax to the budget is registered by separate documents, and to control mutual settlements with the budget will help “Statement of settlements with the budget on income tax”.

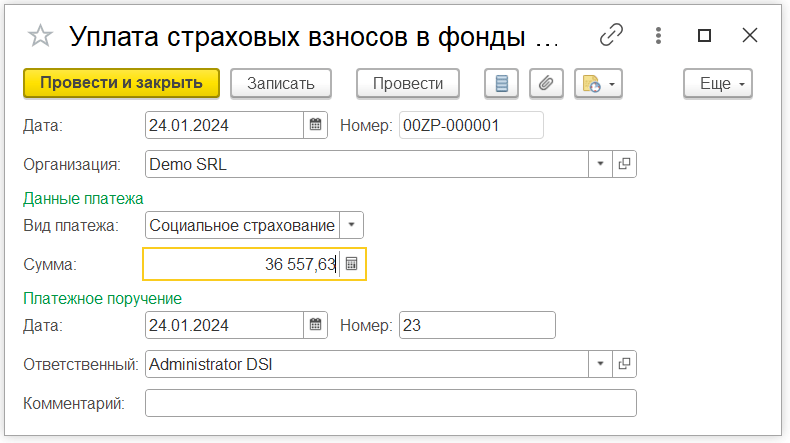

Social insurance contributions are calculated automatically in documents when income is accrued to employees.

Health insurance premiums payable to the budget are accrued automatically when payroll is sent for payment.

The transfer of contributions is registered by separate documents “Payment of insurance contributions to funds”, and the “Analysis of contributions to funds” will help to control mutual settlements with the budget on social and medical contributions.

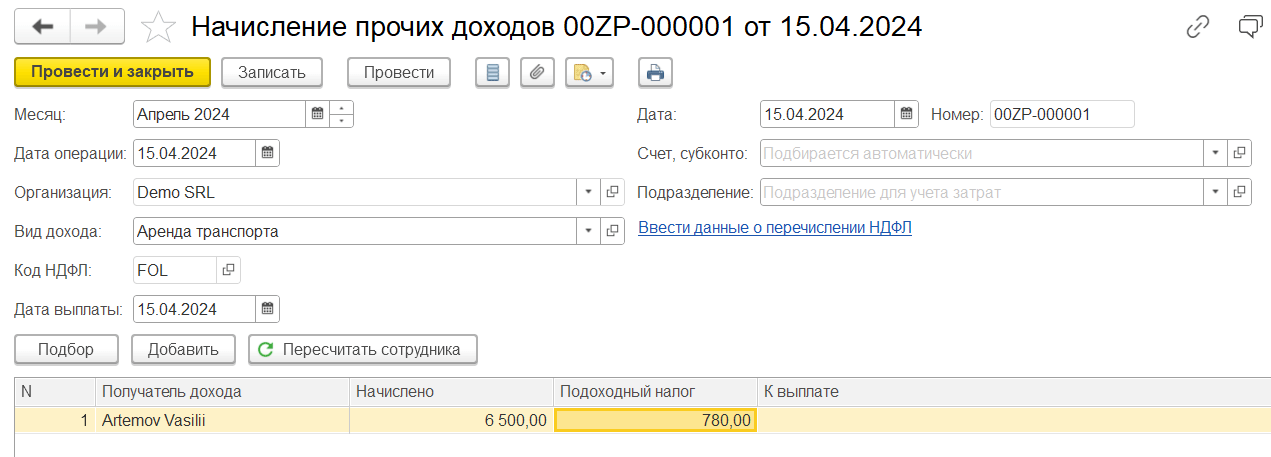

Other income

“1C: Salary and Personnel Management” simplifies the accounting of agreements for the payment of other “non-payroll” income, for example, with landlords. The contract is registered for a long term. Payment of “non-payroll” income can be made in separate statements, and settlements under such contracts are reflected in the counterparty analytics and are not included in payroll sheets and payroll summaries.