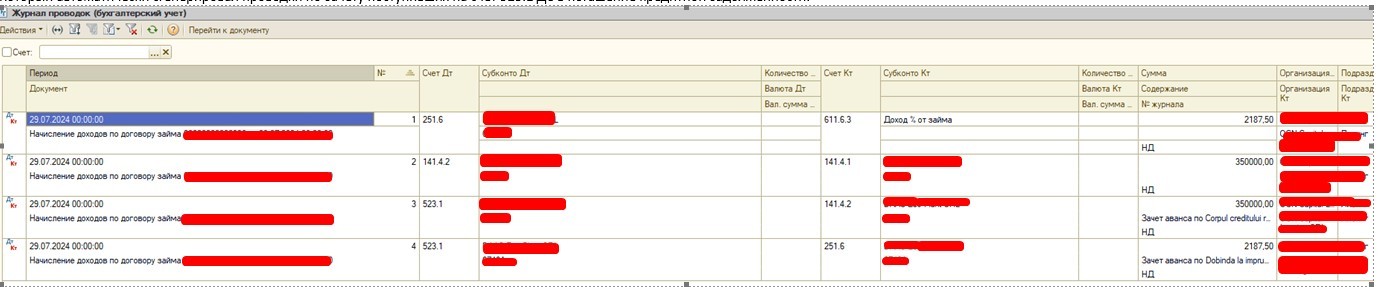

The module of annuity payments is developed on the platform of the standard configuration 1C: Accounting.

This module allows you to:

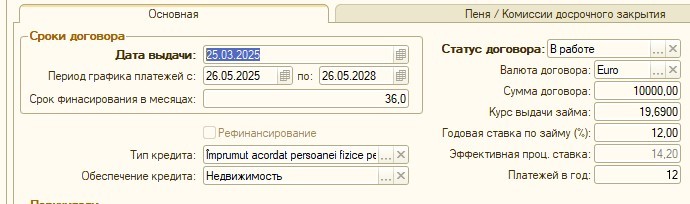

- to calculate the payment schedule containing the amount of annuity, including its components (debt body, interest and commission) based on the initial terms of the contract – the amount and term of financing, frequency of payments, the amount and regularity of payment of commission (Fig. 1, 2);

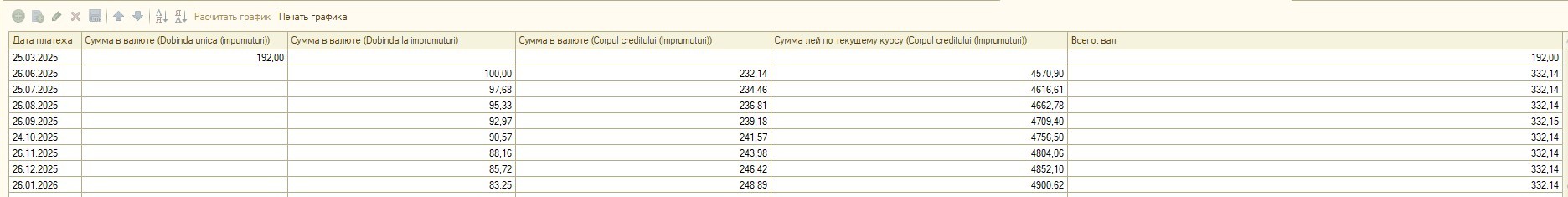

- when calculating the payment schedule, take into account the grace period – when the borrower is exempt from all payments (payment of payments accrued during the grace period is included in the payments after the grace period) (Fig. 3);

- when calculating the payment schedule, take into account the selection of the amount of financing in separate tranches (this is convenient if financing is used for repair or construction) (Fig. 3);

- recalculate the schedule in case of changes in the interest rate and/or fee amount and/or changes in the term of financing and/or changes in the amount of financing, both in respect of an individual contract and a group of contracts;

- recalculate the schedule in case of early repayment of the loan (both full and partial), with three options implemented:

- without changing the term of financing – in this case the annuity value decreases;

- as the term of financing increases – the annuity decreases;

- as the term of funding decreases – with the annuity either remaining the same or increasing.

The described features are illustrated in Figures 1 through 3.

When executing 1C documents, these features are taken into account in the formation of accounting entries automatically, see Figure 4.

More information about 1C: Accounting can be found on the product page.

Share the article, choose your platform!